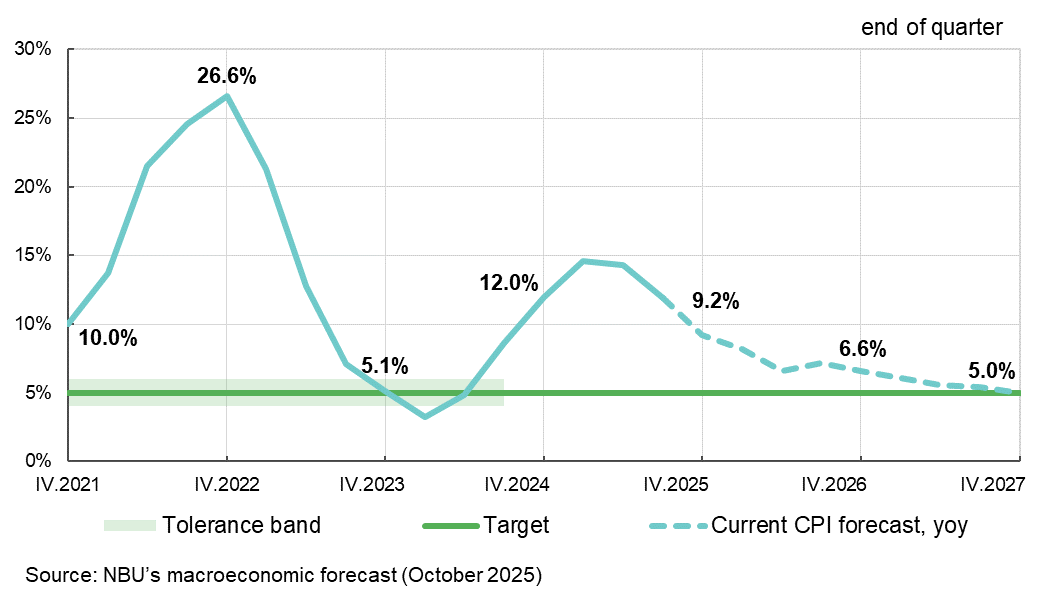

Image description: NBU key policy rate forecast

This infographic shows the dynamics and forecast of the NBU’s key policy rate (quarterly average) from Q4 2021 to Q4 2027.

- The rate rises from 8.6% in late 2021 to 25.0% in 2022 and early 2023.

- It is expected to gradually decline to 13.1% in Q4 2024, 11.6% in Q4 2026 and 10.0% in Q4 2027.

- The dashed line from Q2 2025 onward represents the forecast (not actual values).

Source: NBU’s macroeconomic forecast, April 2025.

In Ukraine’s first years of independence, its economy suffered from high and volatile inflation. This was a result of a tough shift from the central planning to a market economy, as well as a consequence of political interference in the NBU’s work and frequent use of monetary financing to fund budget deficits. Persistent efforts to maintain an exchange rate peg also resulted in significant devaluation and inflation spikes.

Amendments to the Law of Ukraine On the National Bank of Ukraine that were made in 2015 strengthened the NBU’s institutional independence and approved its mandate to maintain price stability. In pursuit of this mandate, the NBU introduced inflation targeting (IT) with a floating exchange rate, a monetary regime where the central bank announces a quantitative inflation target and then achieves it within a certain period – monetary policy horizon.

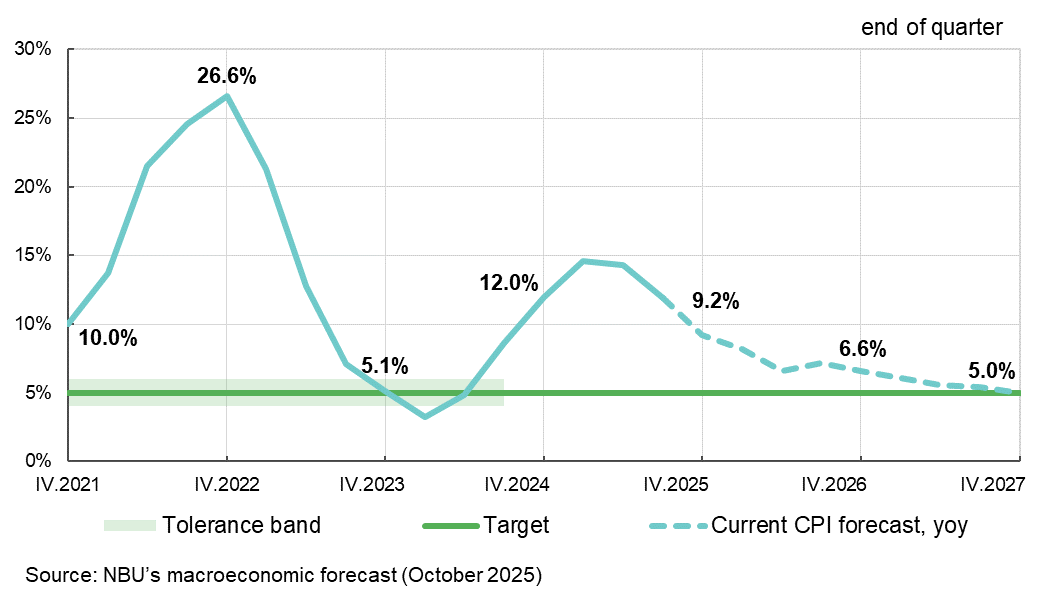

In 2015, the NBU set itself an inflation target range of 5% ± 1 pp and declared an intention to achieve it in the medium term. For several years into its new mandate, the NBU primarily focused on pulling inflation down from high levels and stabilizing people’s inflation expectations following a price surge caused largely by russia’s armed aggression in Crimea and Ukraine’s east (inflation hit almost 25% in end-2014, and 43% in end-2015).

The NBU’s consistent monetary policy made it possible to ease price pressures and stabilize inflation at single-digit levels in relatively short order. In particular, inflation in 2016–2017 fell to 12%–14%. Disinflationary processes continued further. In late 2019 and during 2020, inflation held steady within the target range of 5% ± 1 pp.

The full-scale russian invasion in 2022 forced the NBU to temporarily abandon the IT regime, return to an exchange rate peg, and impose harsh FX restrictions. This ensured the sustainability of the FX market and prevented the expectations of economic agents from becoming unanchored as the new phase of the war unfolded.

As the macroeconomic situation stabilized, with the price surge abating (inflation shooting up to above 26% in the first year of the full-scale war and falling to 5.1% in 2023 already), expectations improving, and the key policy rate’s effectiveness rising, the NBU partially reinstated its IT regime features. Specifically, the NBU in 2023 introduced a regime of managed flexibility of the exchange rate (which, unlike the conventional exchange-rate float, gives the central bank relatively more power in maintaining the sustainability of the FX market) and later confirmed its intention to achieve an inflation target of 5%.

However, the NBU instead of returning to the target range of 5% ± 1 pp moved to a point target of 5%. The policy horizon – the timeframe in which the central bank intends to eliminate deviations of actual inflation from its target – was extended from 9–18 months to three years. These changes helped the NBU to respond more flexibly to macroeconomic turbulence (for more about these developments, see the boxes in the October 2024 Inflation Report).

Considering the war’s consequences, the NBU is applying a flexible inflation targeting regime with an appropriate inflation target and an extended horizon for achieving it (more about current monetary conditions is available here).